capital gains tax proposal canada

In Canada 50 of the value of any capital gains is taxable. While alive the proposed increase to the capital gains tax could dramatically impact high-net-worth US.

The States With The Highest Capital Gains Tax Rates The Motley Fool

That implies that Canadians who use their homes as private residences may defer the taxation of unrealized gains until the time of deemed deposition Cestnick 2021.

. To calculate your capital gain or loss simply subtract your adjusted base cost ABC from your selling price. Person clients living in Canada who sell assets Mr. Under this new policy there would be a new sliding scale tax rate applied to capital gains on home sales.

A federal NDP campaign promise to increase the capital gains inclusion rate to 75 from 50 would bring in 447 billion over the next five years according to estimates released by the Parliamentary Budget Office. In other words if you sell an investment at a higher price than you paid realized capital gains youll have to add 50 of the capital gains to your income. The party released the PBOs costing of its campaign platform on Saturday.

It was a Liberal government that eventually returned it to 50 per cent. While some prognosticators have been crying wolf on this. This means that if youve made 5000 in capital gains 2500 of those earnings need to be added to your total taxable income.

Your capital gain will be taxed at your marginal tax rate which depends on your province and annual income. In Canada you only pay tax on 50 of any capital gains you realize. If the government were to introduce a home equity tax proposal in Canada whereby homeowners had to pay taxes on a home equity payout from their primary residence the fallout could be considerable.

The capital gains inclusion rate is by no means a sacred cow and I suspect it is perpetually on the table as a way to increase tax revenue without having. When the tax was first. A 50 tax after one year of ownership 25 after two years 15 after three years 10 after four years and 5 after five years Scheer said.

Homeowners would be far more reluctant to sell their homes given that they would have to pay a considerable amount of money in capital gains tax. 2286 Pascrell and a proposal by Senators Van Hollen Booker Sanders Warren and Whitehouse not yet introduced as legislation would tax capital gains at death. At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for Canadian-controlled private corporations and 24-27 percent for individuals at the highest marginal rate depending on the province.

This is extraordinarily bad policy that will hurt Canadian families. This means that if you earn 2000 in total capital gains then you will pay 53520 in capital gains tax. Federal Tax Rates for Long-Term Capital Gains Rate Single.

Because Canada has a progressive tax system we are taxed more for every additional dollar we make. While it might seem like a tax the rich policy from Canadas left-leaning party the right-leaning Conservatives raised the capital gains inclusion rate to 6667 per cent from 50 per cent in 1988 and boosted it again to 75 per cent in 1990. This means that half of the profit you earn from selling an asset is taxed and the other half is yours to keep tax-free.

This determines how much of your capital gains youll have to pay tax on. NDPs proto-platform calls for levying higher taxes on the ultra-rich and large corporations. The capital gains tax rate in Ontario for the highest income bracket is 2676.

In Canada 50 of the value of any capital gains is taxable. Canada has taxed capital gains at death since 1971 but has no national estate tax while Australia Ireland and the United Kingdom tax capital gains transferred by gift. Over the last year there has been considerable speculation like most other things these days about the Federal Government increasing the inclusion rate of capital gains tax in Canada.

When investors in Canada sell capital property for more than they paid for it Canada Revenue Agency CRA applies a tax on half 50 of the capital gain amount. The top federal long-term capital gains rate is 20 which is lower than all but two of the seven ordinary income tax rates. The tax brackets for each province vary so you may be paying different amounts of capital gain tax depending on which province you live in.

In Canada the Carter Commission recommended the exemption of a capital gains tax on the sale of a principal residence to encourage Canadians to realize their dreams of homeownership. The Parliamentary Budget Office PBO estimated that raising the capital gains inclusion rate to 75 as the NDP proposed would raise 447 billion over five years. The sale price minus your ACB is the capital gain that youll need to pay tax on.

The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. Currently its 50 in Canada but has been as high as 75 historically. Accelerate Potential Capital Gain Realization.

Thats because their top. In our example you would have to include 1325 2650 x 50 in your income. Capital gains tax rates by province below.

But another thing to consider is the inclusion rate. This has Canada speculating again if a hike to the capital gains inclusion rate may occur in the upcoming federal budget. There have been ongoing rumors about the Canadian government potentially increasing the capital gains inclusion rate from its current level of 50 to a higher level or changing the exemption for capital gains on principal residences.

The amount of tax youll pay depends on how much youre earning from other sources. Youre then taxed based on your particular provinces tax bracket. Although the concept of capital gains tax is not new to Canadians there have been several changes to the rate of taxation since its introduction in 1972.

Here is a breakdown of what rates your long-term capital gains will be taxed at for the 2021 tax year. The other long-term capital gains tax rates are 0 and 15. Election platform the NDP proposed to increase the capital gains inclusion rate to 75 from 50.

If you sell a capital property like an investment condo to your children for example for a profit of 250000 your marginal tax rate would be a full 4341 in Ontario according to this free online tax calculator. The federal budget date has not yet been announced but if a change is. Aaron Hector vice-president and financial consultant with Doherty Bryant Financial Strategists in Calgary agreed.

Tax Tips 2016 Investment Income Capital Gains And Losses Tax Canada

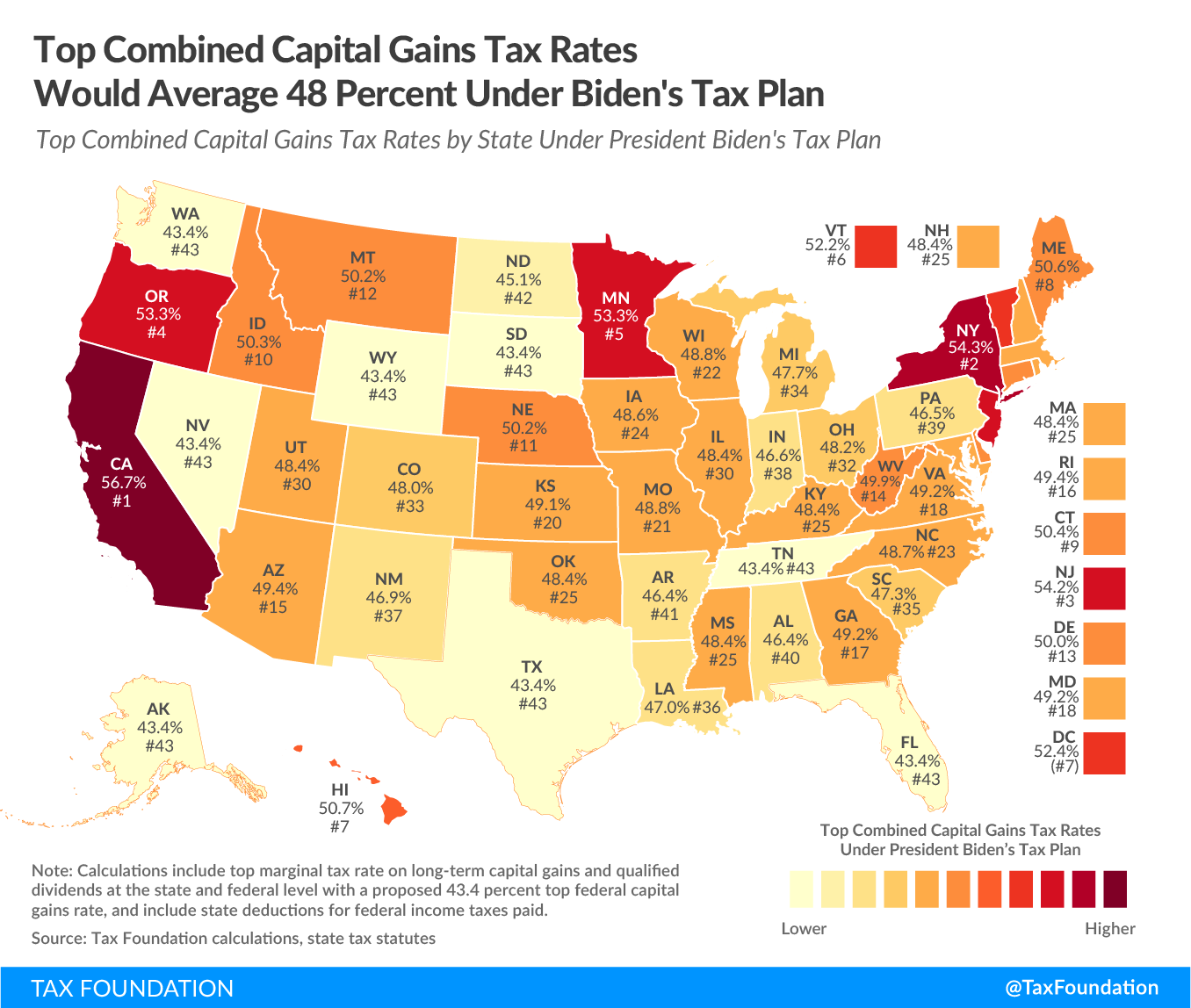

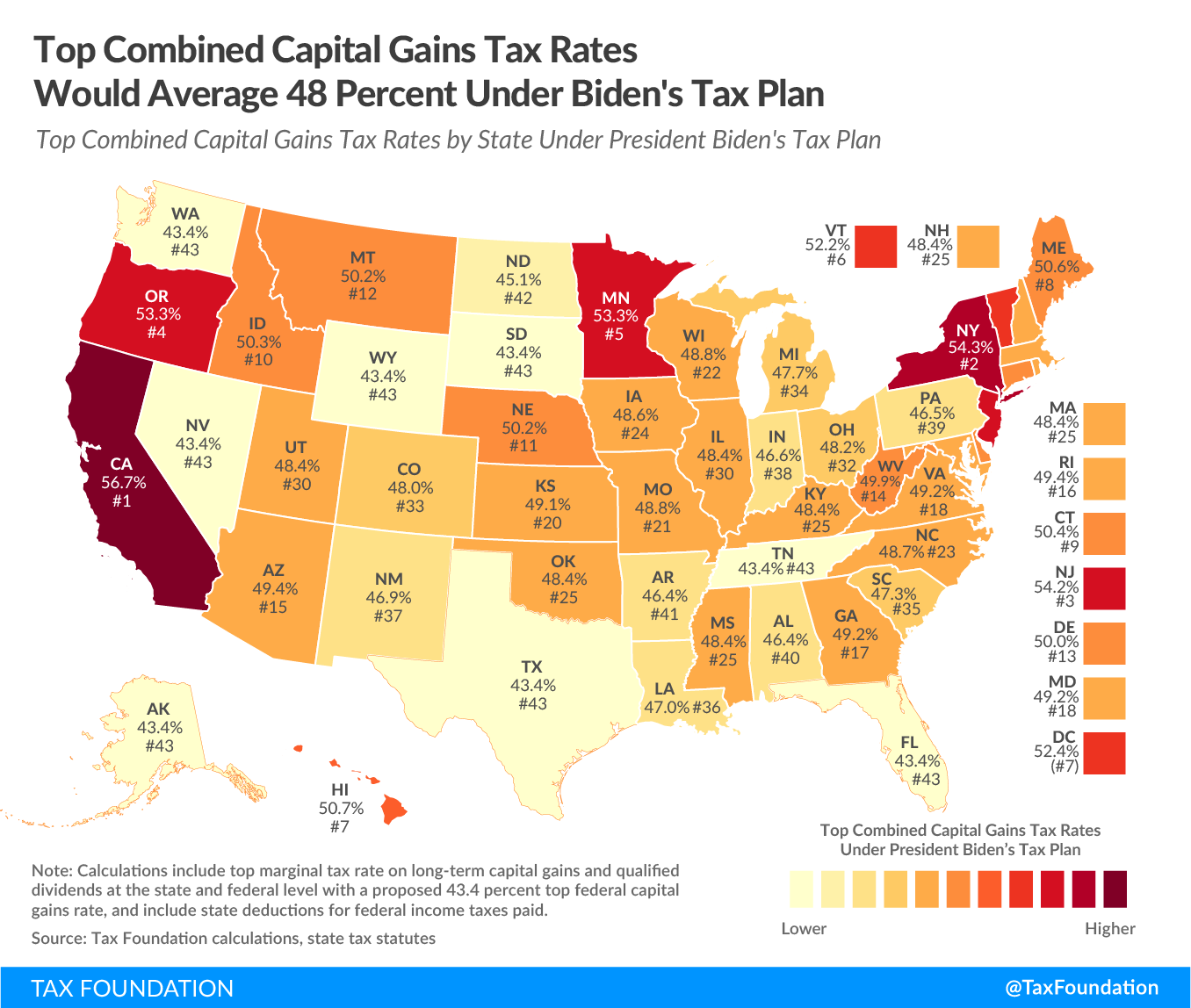

Combined Capital Gains Tax Rate In Michigan To Hit 47 7 Under Biden Plan Michigan Farm News

How Biden S Build Back Better Hits Blue States Harder

Tax Tips 2016 Investment Income Capital Gains And Losses Tax Canada

Possible Changes Coming To Tax On Capital Gains In Canada Smythe Llp Chartered Professional Accountants

How Are Dividends Taxed Overview 2021 Tax Rates Examples

The Looming Capital Gains Tax Hike The Potential Impact On Businesses And Individuals Sc H Group